Report | Rich in Flows, Poor in Perception: A Diverging Narrative of US Capital Positioning Under Trump 2.0

Thus far in Trump 2.0, capital has poured into US equity and bond funds at a pace unseen since 2020.

But beneath these headline flows lies a more nuanced story.

But beneath these headline flows lies a more nuanced story.

CEIC Data and EPFR invite you to read our joint white paper on US capital positioning as we approach the final quarter of 2025.

Our team of economists explore how:

-

Active fund managers with diversified mandates are reducing their exposure to US assets

-

The US dollar faces continued pressure, even though the "Liberation Day" shock to its safe-haven role has ebbed

-

Sector-level allocations reflect rising concentration risks and an increasingly defensive mindset

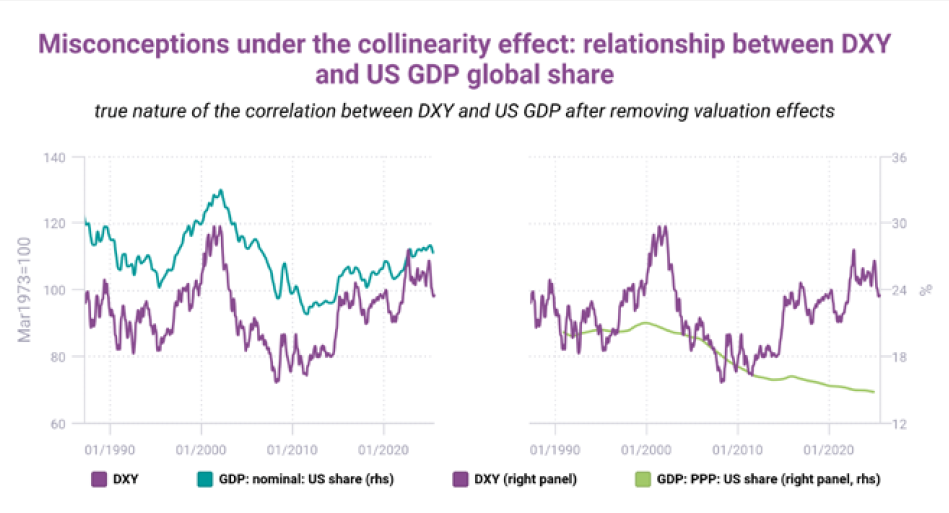

Tapping the power of EPFR's exclusive fund-flow data and CEIC's wealth of macroeconomic indicators, we dissect these trends. We also perform a deep analysis of the US Dollar Index and its drivers: DXY is still primarily driven by short-term yield differentials, market risk sentiment, and structural factors like the dollar's reserve currency role.

Liquidity and confidence are diverging. The first half of 2025 highlighted a disconnect between capital flows and actual investment positioning. Fund managers are reallocating exposure and hedging against rising macro and currency risks.

Disclaimer: All opinions expressed in this on-demand video do not reflect the views of ISI Markets, CEIC, EMIS, REDD or EPFR. All written and electronic communication from ISI Markets, CEIC, EMIS, REDD, and EPFR is for information or marketing purposes only and does not constitute or qualify as substantive research.